Third-party Funding and Mixed-economy Company: working to improve the energy efficiency of the private condominiums

2014

Fonds mondial pour le développement des villes (FMDV)

Launched by the Ile-de-France Région and mobilizing various partners, the SEM Energies POSIT’IF aims to initiate a real momentum in favor of energy renovation.

Europe must undergo an energy transition, but this latter is being slowed down by many economic, financial, cultural and political obstacles. Improvement of the energy efficiency of the private housing stock is a crucial issue for the sustainable future of local communities. It is also a market with strong growth potential, in which the Île-de- France Region has chosen to invest in order to encourage the sustainable trigger among condominium owners.

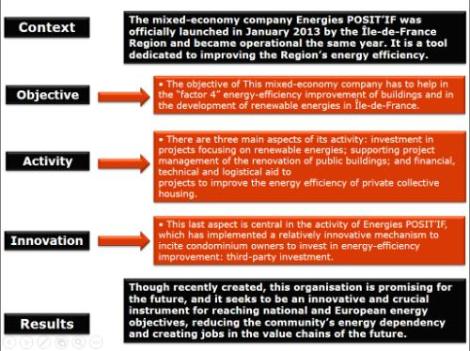

The Île-de-France Region consumes more energy than any other French region, and it is 70% dependent on fossil resources produced outside of its territory1. This profile has serious consequences for the region economically (energy import costs, potential jobs uncreated), environmentally (GHG emissions), and in terms of society (increasing number of households facing energy insecurity). The Île-de-France Region has thus set ambitious objectives in which improvement of the energy efficiency of buildings and support for renewable energies are playing a central role. The mixed-economy company Energies POSIT’IF was created for this purpose and is in charge of initiating a thirdparty- funding market in the Île-de-France Region.

To download : local_innovations_to_finance_cities_and_regions5.pdf (1.5 MiB)

The energy-consumption reduction objectives seem difficult to attain, as the energy efficiency projects are facing many obstacles. The foremost of these is market failures, which are closely linked to a lack of long-term vision of political, economic and financial systems. Energy efficiency operations therefore often require significant initial investments, which have a return over the long term and a high-risk profile. Yet, most of the financial market players offer contracts for limited improvement of energy performances, with short-term payback. More generally speaking, we can still see a lack of involvement by financial players in this field. The other major obstacle is cultural, as the energy transition is often perceived as a constraint rather than a promising investment. It is within this context that the mixedeconomy company Energies POSIT’IF was created, to further the implementation of more ambitious projects and cooperation among energy-efficiency players.

Combining an innovative financial engineering with an adapted institution.

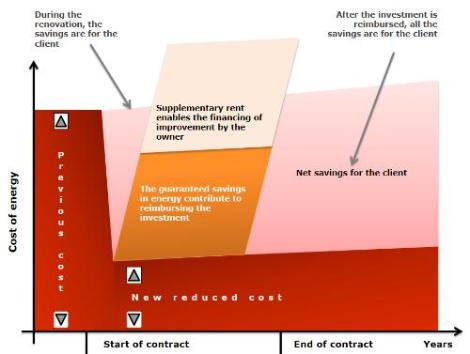

The SEM (mixed-economy company) Energies POSIT’IF (FOR “Promote, Or ganise, Support and Invent the Energy Transition in Île-de-France”) has a capital of €5.3 million provided by the Île-de-France Region and its partners. It can invest in renewable energy projects and offer financial, technical and logistical aid to projects to improve energy efficiency for private condominium buildings, which are often denied public aid. Energies POSIT’IF thus fills a gap in the building-renovation market and helps renewable energy projects by supporting the implementation of programmes that are difficult and complex to realise in an ordinary economic and financial context. For example, to encourage the condominium owners to start up energy-efficiency improvements in their building, Energies POSIT’IF offers to advance part of the funds for them, through an original “third-party-funding” instrument. Third-party funding is a financial arrangement that enables the owner (or association of owners) of a building to finance renovation though a third party if their own funds are lacking. This third party is then paid back in instalments over a contractually defined period. In a real estate’s energy-efficiency improvements scheme, the principal of third-party investment is based on the energy savings the building occupant obtains following the renovation and that acts as the main source of payments used to pay back to the third-party funders (in this case, Energies POSIT’IF). In other words, the third-party investment relieves the client of some of the renovation financing by mobilising and securing a future financial resource: the energy savings (see figure). However, implementation of this mechanism presupposes a contractual commitment to guarantee energy efficiency, in order to reassure the owner of the building (and the third-party investor).

The key role of Energies POSIT’IF

Energies POSIT’IF works by providing a combined offer of financing (third-party investment and subsidised loans) and technical expertise that allows it to select the appropriate projects, take on the role of coordinator and manage the technical risks over the long term2. It draws up a contract with condominium owners or the condominium management associations and takes care of coordination with the renovation financers, technical experts and contractors. It is also in charge of monitoring the work, and it advances the initial financing, which is reimbursed over the long term (15-25 years). This simple way of operating limits the procedures that have to be carried out by the clients, who transform their savings in expenses into investment. For its part, Energies POSIT’IF optimises transaction costs through economies of scale. Over the long term, it seeks to initiate real dynamics in favour of energy-efficiency improvements by showing that the system is viable not only for the condominium owners but also for the players in the private sector.

Source: CDC, 2010

A promising but still new project

As Energies POSIT’IF was created in 2013, it is difficult to evaluate the results of this initiative. However, the project, which has received awards at the national level, remains promising because it works at different levels: by correcting the market’s imperfections regarding energy-efficiency improvement, it improves the energy efficiency of buildings all the while generating many positive outcomes. Thus, these renovations aim to reduce household energy insecurity in the region, as well as the region’s energy dependency; at the same time, they are factors of employment in the energy value chain. For the condominium owners, the implementation of ambitious energy-efficiency improvement work leads to improvement in comfort and the value of their condominium, as well as in a decrease in their energy bill. Energies POSIT’IF also helps strengthen cooperation among those involved in energy-efficiency improvement and can act as an “example” showing the profitability of ambitious energy-efficiency improvement projects, thereby encouraging other players to take over. However, lack of commitment by the financial stakeholders, condominium owners and public authorities remains a major obstacle to the sustainability of the organisation: getting investors to become involved in such projects is thus crucial in the success and continuation of Energies POSIT’IF. Long-term funding for the organisation thus remains a crucial issue, given the gap between the carrying out of the work and the return on investment. The challenge thus remains of structuring financial resources in this sector in order to make them ongoing and attractive. Furthermore, Energies POSIT’IF’s offer is granted especially to Île-de-France collective housing, 50% of which is made up of condominium buildings, but not necessarily to other real estate contexts. Reflection on tools adapted according to the situation must continue. Political backing, as much in terms of mobilisation and communication as in funding, has been crucial in the implementation of Energies POSIT’IF. The public authorities are responsible for establishing a legal framework that can facilitate the realisation of such initiatives: third-party investment in France was hindered for a long time by the lack of legal measures to encourage it, and the ALUR law3, which enshrined third-party investment into French law in February 2014, has greatly facilitated the implementation of energy-efficiency improvement operations. Finally, the mixed-economy company format of public/ private shareholding seems to be especially appropriate, in that it can reassure the participating condominium owners, facilitate governance and raise large amounts of money.

Source: FMDV, 2014

1 DRIEE (2013)

2 As project manager, Energies POSIT’IF provides guaranteed results and undertakes to achieve a minimum level of energy savings (around at least 40%).

3 The ALUR Law (Law for Access to Housing and Renovated Urbanism) was passed in February 2014. Its objective is to reduce housing costs for tenants and to reform the management of collectively owned housing.

To go further

Complete case study to be published on the REsolution website

Caisse des Dépôts et Consignations document on third-party investment (in French):